Well, maybe. One of the great things about reading Jimmy Palmiotti and Justin Gray's Jonah Hex series is that, aside from the sheer badass adventures of the meanest, ugliest, most violent bounty hunter in the old west, there are lots of subtle implications about economic development in the late 1800s United States, specifically regarding the massive industrialization and business expansion.

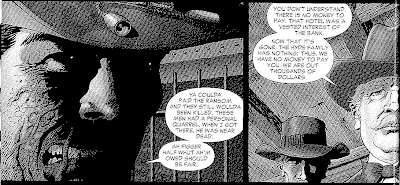

In his latest adventure, Hex was hired to rescue a hotel owner/manager and his daughter from a gang who had kidnapped them. In the process, Hex had burned down the hotel and upon attempting to collect his fee, the bank (who evidently hired him because of their interest in the hotel) informed him that they would be unable to pay for his services. The reason being, simply, that he burned down the source if income with which they would have paid him.

You might be wondering why it is that the bank would elect to honor their agreement at all, being that Jonah Hex technically operates outside the law. The reason is, also simply, that they fear Jonah's wrath on them might exceed that of his on the gang and the hotel.

So, we have a problem where the bank and hotel owners have no money to pay Hex. The solution that is eventually agreed upon is that the hotel owner would transfer ownership of the land on which the hotel was built over to Hex, who gladly accepts, declaring the land a fine form of currency in the rapidly industrializing economy.

I have a few comments on this:

1) I'm a bit confused as to how this transfer of ownership works. I'm not a real estate expert, especially concerning 19th century property values, but it seems to me that this is the basic way it works: someone wants to open a hotel, so he or she goes to the bank to acquire a loan for land (remember that land is considered real property and also one of the four basic factors of production in classical economics) as well as the capital to actually build the hotel. The new business owners now use the profits they earn from the hotel in order to pay back the loan, however the bank still technically owns all or part of that property until reimbursed. This is what I think the bank owner meant when he said that they had a "vested interested" in the hotel.

So, now that the hotel is burned down and the family has no means of paying back for the loan (and has no property insurance!!), it seems to me the equivalent of a default. Obviously, in this situation, it is perfectly acceptable to transfer land ownership to someone who could pay the rest of the loan (and this would also save on foreclosure costs, legal and administrative expenses, etc., and and save the owner from applying for bankruptcy), but wouldn't this still mean that Jonah would have to pay the bank? Unless his fee was so large or the amount the hotel owed was so small that they just considered it even (which I doubt) , I would think Hex would still owe the bank. And that doesn't sound very Hex, does it?

2) This demonstrates the importance of insurance (superhero insurance will be the topic of a later post).

3) Hex's comments on the last page confuse me. When asked what he would do with the land, he profoundly respond, "It's currency." Then he goes on to talk about the growth of towns and railroads, which leads to the implication that Jonah might want until the value of the property increases before he sells it to inevitably expanding businesses who might need the land. This is, first of all, an incredibly shrewd and economic tactic that is surprising coming from such a notoriously rough-around-the-edges bounty hunter. Secondly, however, Hex then goes on to say "with railroads and towns poppin' up, it's gettin' so a person can't keep to themselves. Best thing ta do is leave it clear and free." Does this mean that he actually just wants to keep the place and not sell it eventually?

All in all, Jonah Hex is a more shrewd economist than I would have guessed.

16 comments:

From what I understand, bank money in the old west was generally tied in with long-term investments such as hotels, saloons and farms. Not the most diversified portfolio of investment opportunities. Add the frequent recessions and bank robberies and you have a pretty risky business.

When a debtor defaulted on a loan, the bank would be stuck with a piece of hard-to-value property whose price could fluctuate wildly. Paying taxes on this while trying to find someone to sell the land to might be a losing proposition for the bank. Maybe the bank felt it easier to simply allow the transfer of property from the hotel owner to Hex, thereby settling their contract with him. Contracts back then were informal at best, and nobody wants an angry bountyhunter on their ass.

Its also possible that the bank had already inspected the land and came to the conclusion that it was worthless. Maybe Hex isnt as shrewd as we think?

Here's where I'm confused. How would the bank have recieved liquid value off the property to pay Hex? If they have a vested interest and not sole ownership, they cannot liquify to pay him. It seems like the whole situation is fishy which is why I can see them allowing him to take ownership of the land. Perhaps assumed he knew what they were scheming and elected to give up the land to face that legendary wrath.

As far as the issue of the value of the land to Hex himself, value is only based on the utility one places on it. Untangle all of Hex's motives and you'll see whether he means to hold the land for money or to hold the land as wild, free space (at least until seized in eminent domain).

The fault in your analysis is that the bank never has any actual ownership of the property. A mortgage is actually just a contract in which the bank gives a some of money to the borrower in exchange for the right to collect that money back over time plus interest. The borrower has sole ownership of the property he buys, but if he fails to pay as agreed, the bank can collect the property instead of the money.

In this situation the hotel is destroyed and the owner's can't pay. The bank could foreclose on the property, incurring legal costs, but then they still have to sell the land before they get any money. There are two problems with this. First, the value of the now undeveloped land is only a fraction of what the bank is owed anyway, so they are guaranteed to lose money no matter what. Second, bankers aren't real estate speculators. Selling the land will require them to hire someone, more costs, and they are unlikely to get top dollar. Getting the land off their books quickly is a greater priority than getting the best price, because they have no way of not losing money anyway.

Given the reality of how difficult it is for a bank to get money out of a property, they decided to allow a short sale of the land to Hex for the price of his fee. They get both the land, and the fee off the books (and keep Hex from asking questions about where else the bank could find the money to pay him), so over all it's a pretty good deal for the bank.

Of course, all this trouble could be avoided if there was insurance on the building, which a shrewd banker would have required.

Erik is basically correct, but keep in mind that a mortgage is an interest in the land, given by the mortgagor to the mortgagee.

So, for this to work, the bank would have to convince the present estate owners to convey their interest in the land to the bank, at which the point the bank would own it free and clear. (This is the magic of merger.) Then the bank may convey it to whomever it wishes.

Absent merger, you may just have the bank conveying a mortgage interest to Jonah (and presumably the promissory note to which it is attached), which means that Jonah would have to foreclose (sale of the property) in order to acquire a fee simple property interest.

Of course, even foreclosure does not guarantee fee simple ownership as the process generally involves an auction. Usually the mortgagee (the bank) bits up to and including the amount outstanding on the promissory note, which gives the mortgagor the property for only the amount it is owed, and it can then sell the property at a profit (not so much these days).

In short, it's a lot more complicated than the comic makes it sound. Which makes sense.

I'm not sure there was a prior deed on the land. These ladns were likely granted by the homestead act or purchased outright form the railroads, who were granted it by the gov't in a infrastrcuture deal akin to the interstate highway system in the 1950s.

The loan that entails would've been a construction loan.

I could be wrong, but I believe that older mortgage systems actually vested title in the property to the mortgagee while allowing the property "owner" to use the land either under lease or permission (in contrast to the current systems in the US where the property owner has legal title subject to the mortgagee's interest). Thus, absent the intervention of Equity, the bank would own the entire property until the last payment was made.

Of course, I'm not a real estate lawyer and Property was not my best subject in law school so take these recollections with that salt in mind.

Well, let's assume for the sake of argument that the hotel was built with at least a loan for construction, possibly for land purchase as well (and if not land purchase, then the parcel was part of the loan collateral). Let's further assume this means that the bank can immediately foreclose on the property in toto, allowing them to sign the deed over to Hex as payment for his services.

Even so, this is pretty fishy. What bank is going to have the repayments on a single loan (extended with what initial capital?) be its sole source of liquid income, with no deposits or other source of cash? Just how high was Hex's fee supposed to be, anyway?

Its really confusing case. I can just say Best OF Luck! to you.

You can do most of this in software for free. Try Jeskola Buzz. Its is a VST capable modular software music studio.

Property management Companies Orlando

It's very sad , that many people in america are under huge loss due to recession in market. Lot of them are jobless now.mp3

We added your article to our auto glass directory. You’ll find there is link to this blog

Buy Justin Bieber Silly Bandz

This may be a perfect example of information asymmetry and adverse selection in insurance. I hope all textbook authors and legislators notice.

I was more than happy to seek out this site.I wanted to thank you for this nice read!! I definitely having fun with each little bit of it and I have you bookmarked to check out new stuff you post. Anyway, in my language, there usually are not a lot good source like this.

Daniel, yea I can see what you probably did there. I really appreciated that part, however hehe I am not that harsh like my dad with these things. He at all times tells me crazy stories again in the day and calls me a loser. I guess it's time I move out of my dad and mom' basement LOL. Aaanyways, what about you? what does your dad think xD" Anyway, in my language, there are usually not a lot good source like this.

Excellent information here. This attention-grabbing publish made me smile. Possibly when you throw in a couple of footage it's going to make the entire thing more interesting. Anyway, in my language, there should not much good source like this.

this page | here | there | check this | this site | here | this page

here | this site | this page | there | check this | this site | here

here | this site | this page | there | check this | this site | here | this page

Post a Comment